The Test of the Unpaid Internship

When it comes to internships, or any work for that matter, the best practice is to offer paid positions. However, if your organization finds itself needing support, you can explore unpaid internships and the Department of Labor has outlined several criteria for unpaid internships:

- One of the main keys to note is the work the intern is doing cannot replace the work of a full-time employee.

- Per the U.S. Department of Labor, the Fair Labor Standards Act requires “for-profit” employers to pay employees for their work.

- Interns and students, however, may not be “employees” — in which case compensation is not required. Employers should note that the best practice is to pay interns when at all possible.

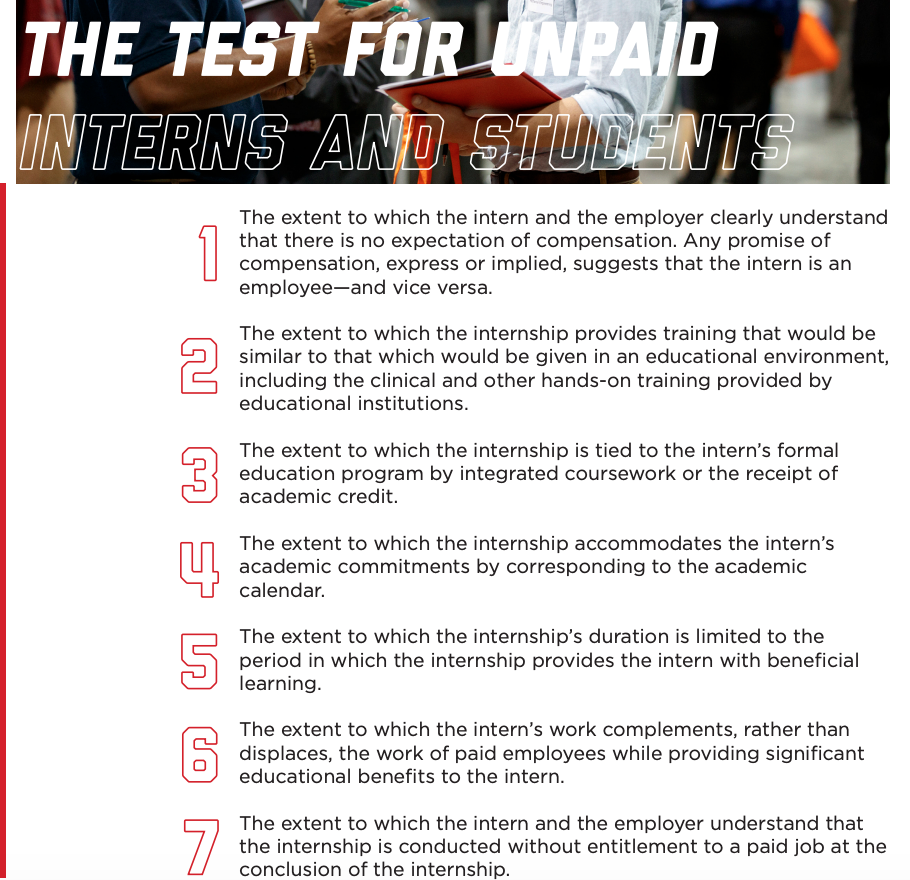

- Courts have used the “primary beneficiary test” to determine whether an intern or student is, in fact, an employee under the FLSA. In short, this test allows courts to examine the “economic reality” of the intern-employer relationship to determine which party is the “primary beneficiary” of the relationship.

- When considering intern pay rates, it is recommended that employers consider carefully what the “average wage” for interns from a particular university or geographic area is, the cost of living, the opportunities for pay students give up when accepting internships instead of part-time jobs, and what kinds of candidates the employer would like to attract.